Picture supply: Rolls-Royce Holdings plc

Rolls-Royce (LSE:RR.) shares have been standout performers amongst FTSE 100 shares in 2023. Having risen by an astonishing 144% in lower than a 12 months, potential buyers is perhaps forgiven for asking themselves whether or not the Rolls-Royce share value is now slightly costly.

But, regardless of buying and selling close to a 52-week excessive, the inventory continues to be down 17% from the place it was 5 years in the past. Lengthy-term shareholders will hope the aerospace and defence large’s post-pandemic restoration has additional to run. In spite of everything, at £2.41 right now, the share value continues to be nicely beneath the all-time excessive of £4.42 it reached again in 2014.

So, let’s take a more in-depth take a look at the Rolls-Royce’s funding prospects right now.

Valuation

First, it is smart to sort out the topic of valuation head on.

For the reason that firm generates almost 47% of its income from delivering and sustaining civil plane, it suffered enormously within the pandemic resulting from strict journey restrictions. Throughout this era, Rolls-Royce was a loss-making enterprise.

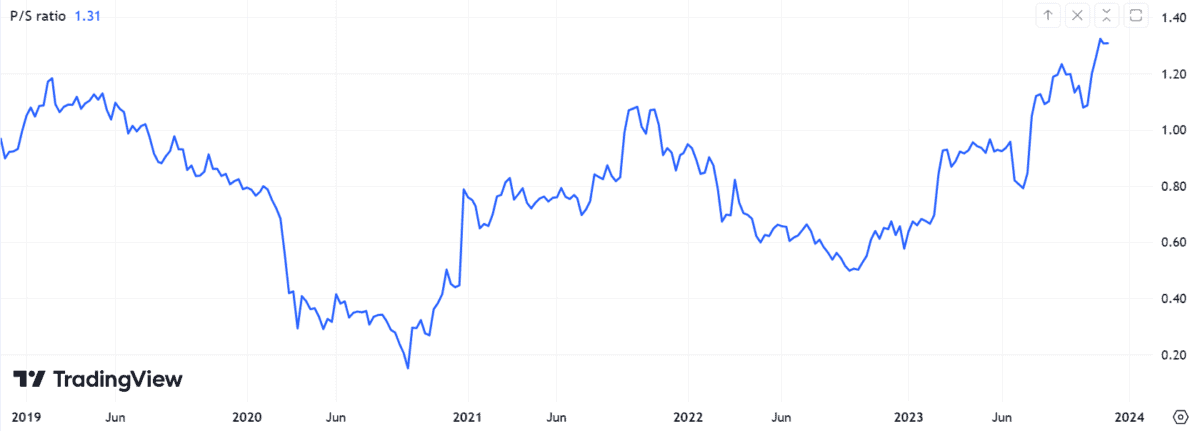

Subsequently, I imagine it’s extra enlightening to take a look at the agency’s price-to-sales (P/S) ratio, slightly than the extra extensively used price-to-earnings (P/E) ratio, to gauge its valuation right now.

Because the chart above exhibits, Rolls-Royce shares are presently dearer, in keeping with this metric, than they’ve been at any level within the final 5 years.

Consequently, worth buyers could have reliable issues that the corporate will battle to generate comparable returns in 2024 in comparison with the final 12 months.

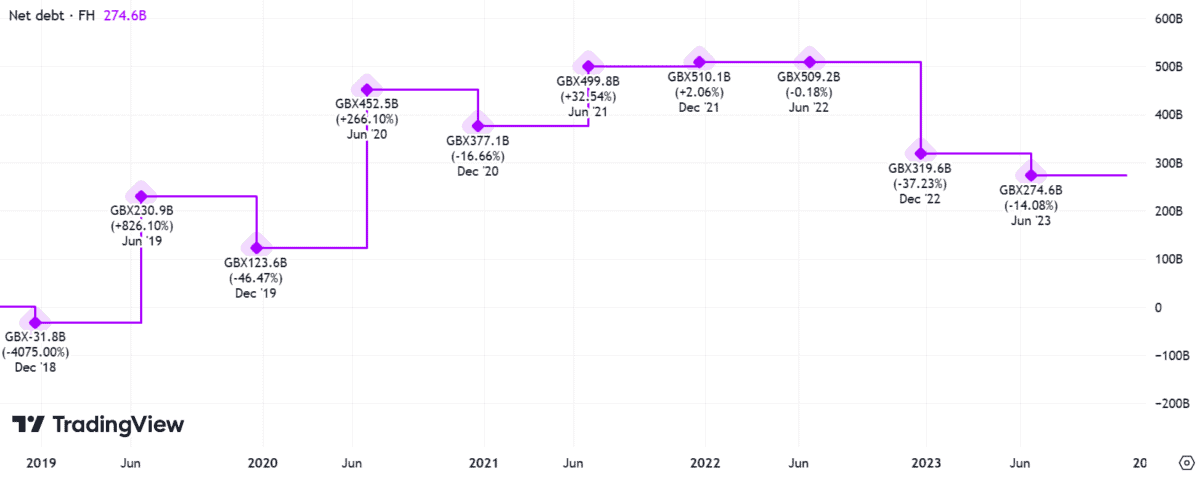

Web debt

Turning to the stability sheet, Rolls-Royce has made good progress in decreasing the debt mountain it constructed throughout the pandemic. In H1 2023, this determine improved to £2.75bn, having ballooned to £5.1bn by the tip of 2021.

All the main credit standing businesses now have a optimistic outlook on Rolls-Royce. That mentioned, the group has but to return to an investment-grade ranking.

| Company | Credit score Score |

|---|---|

| Moody’s | Ba3 |

| Fitch | BB- |

| S&P | BB |

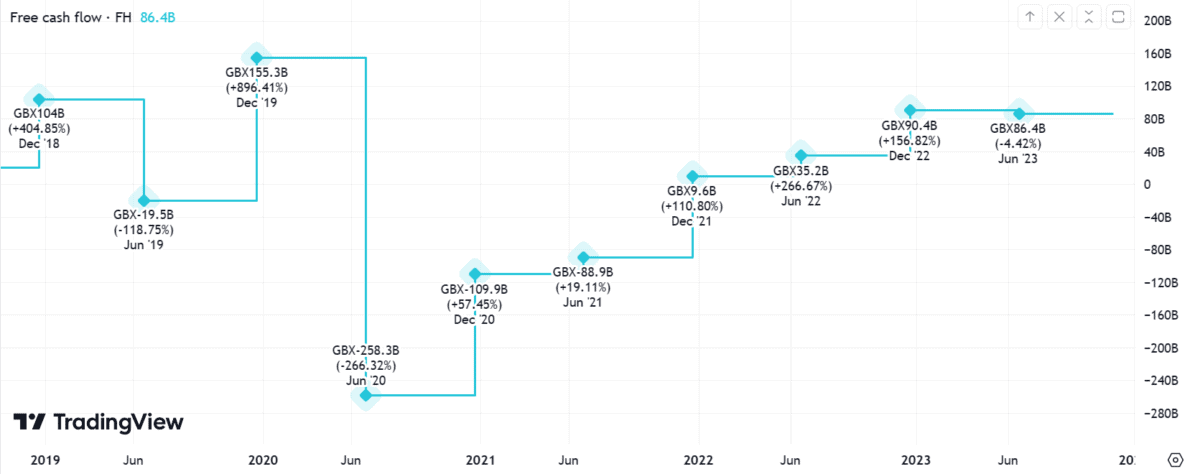

Free money stream

I’d prefer to see the corporate generate stronger money flows over the approaching years, because it has solely just lately stemmed its outflows — however the trajectory appears encouraging. This would possibly translate into ranking upgrades down the road.

CEO Tufan Erginbilgic has acknowledged the corporate was gradual to reply to the inflationary surroundings with value hikes for its providers.

This might bode nicely for future money stream enhancements. Rolls-Royce arguably has headroom to capitalise on its aggressive benefits in elevating costs additional.

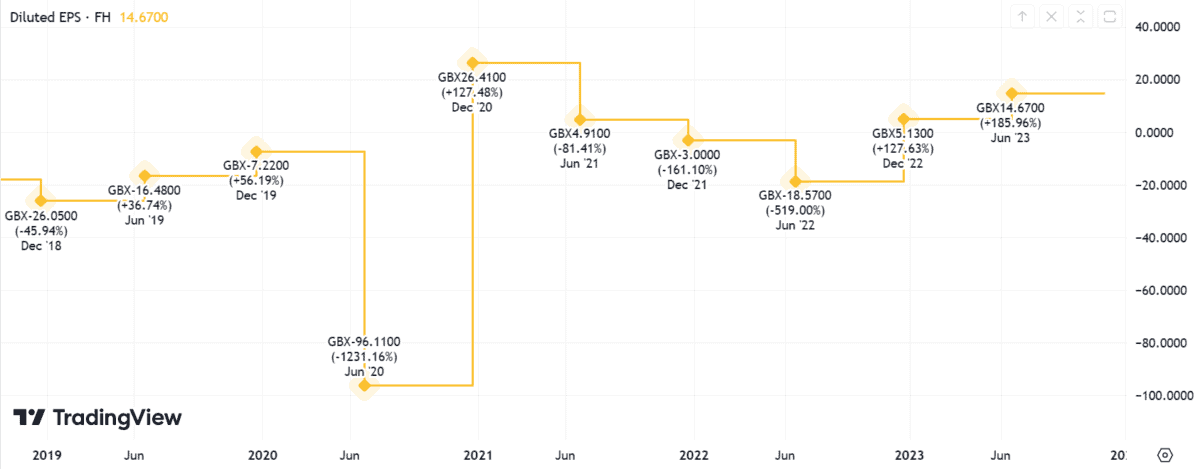

Profitability

Lastly, diluted earnings per share (EPS) are almost again to the place they have been pre-Covid.

This significant profitability metric is the determine that actually catches my eye. It tells the story of Rolls-Royce’s exceptional turnaround below Erginbilgic’s management.

A inventory to purchase?

It’s honest to say development within the Rolls-Royce share value over the previous 12 months has been nothing wanting spectacular.

A continued restoration in civil aviation flying hours, profitable submarine offers flowing from the AUKUS defence pact, and ground-breaking expertise for small modular nuclear reactors all add weight to the funding case.

Nevertheless, the inventory isn’t as low-cost because it was. Buyers is perhaps smart to restrict their expectations if coming into positions right now. Nonetheless, I’m a shareholder and can proceed to carry my place with the prospect of potential dividend reinstatements on the close to horizon.